“Mama, when I grow up, I want to be a baseball player”

“Mama, I must have practiced hitting when I was in your tummy!”

These are actual conversations with my six year old. In the winter time substitute baseball for hockey and hitting for scoring! It’s clear that my son is a huge sports fan and that means he wants to play, play, play all the time. While I’m a big believer in free play and doing most of those activities in the park as a family or with his friends, we also sign him for sports programs and camps.

Since Kyle turned four, he’s been playing in a hockey league. The first year it meant games every Saturday at 7 am!!! In the Spring, he plays baseball. A few years ago we just signed him up for a program through the city. It was cheap and close to home. This year, we signed him up through a private league as he was ready to play more “seriously” (or as seriously as a five year old can play). His love for baseball has grown since then that we’ve signed him up for two weeks of baseball camp throughout the summer.

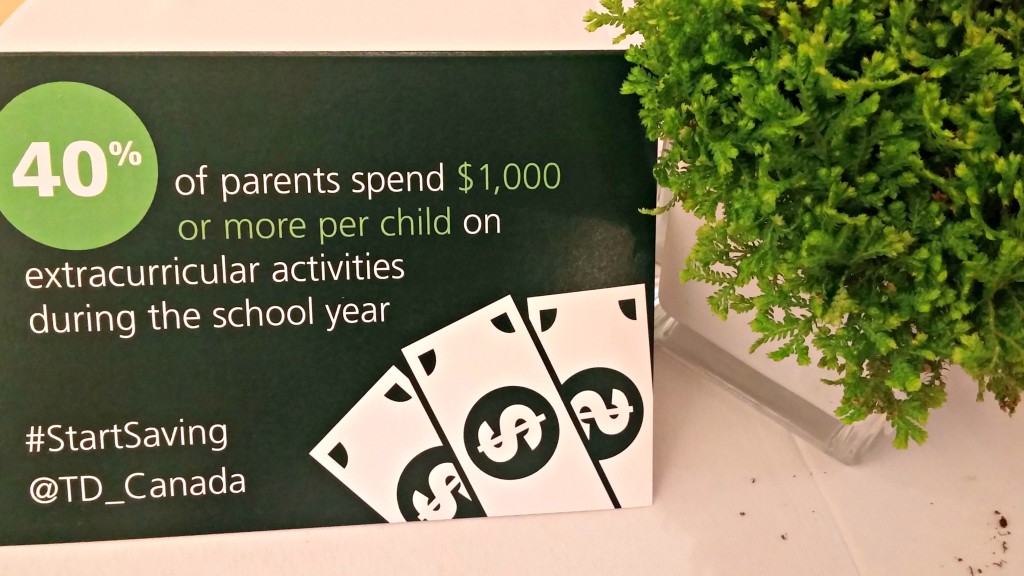

However, the cost of the programs and camp add up. According to a recent TD survey, four in ten Canadian parents with children under 18 years old spend $1,000 or more on extracurricular activities per child during the school year and half of parents find budgeting for these activities stressful. Unfortunately, half of Canadian parents say they either limit the number of activities or don’t sign their kids up for extracurricular activities at all due to cost. So what’s a family to do? How do you make sure you can afford extracurricular activities?

Luckily, I have some tips to share on that front as I recently attended a TD event where we had some great conversation around affording extracurricular activities for your kids. Shirley Malloy, Associate Vice President of Everyday Banking at TD offered six great tips to make extracurricular activities affordable.

- Avoid Costly Surprises – Think beyond just the cost of the class itself. I know that for hockey, an expensive component is the cost of the gear. Especially if your child starts young, they may have to upgrade their equipment every few years as they grow. When you budget for programs, make sure to take into account ALL costs associated, not just the price of the class.

- Create a budget and stick to it – Think about the entire year and what programs your kids will be in and then add another 5 to 10% for unforeseen expenses. Include these costs in your monthly budget. You can use online budgeting tools to help you determine how much you’ll be spending monthly and ensure you stay on track. Save some money on a monthly basis and even get your kids involved in the budget and saving exercise to teach them about budgeting and savings. They can never be too young to learn!

- Shop around for discounts – In my experience, most programs offer discounts if you sign up early enough or sibling discounts. You can also save on equipment by buying them gently used or borrowing them from neighbours, family or friends.

- Don’t invest too much up front – Before you go “all in” and spend fortunes for private lessons or private-run programs, make sure your kid actually enjoys the program. Classes offered through the city are usually much more affordable and you can get your money back if you withdraw, even half-way through.

- File your receipts – Not only will they help you with budgeting for next year’s programs, but you might be able to put some towards the 2016 fitness tax credit.

- Return on Enjoyment – The most important part of an extracurricular activity should be whether or not your child is enjoying it and learning from it (whether it’s interpersonal skills, team work, or problem solving skills). Sit down with your child at the end of each month and inquire about their experience to ensure everyone is still enjoying themselves!

What other tips would you share regarding budgeting for your children’s extracurricular activities?

Disclaimer: I received compensation from TD as part of my participation in the #StartSaving #BacktoSchool event. The opinions, stories and kids I speak of are all (proudly) mine!

These are excellent tips. Thank you for sharing, I am going to share this with my readers!

YES. YES. Save those receipts. The tax benefit is important. I can only also say be realistic. Is it fun and do they like it? – GREAT! Is it good for them? Of course! Are you going to invest thousands in competitive play/ camp etc only to realize they are not the next Crosby…well, parents need to walk a bit of a delicate line there with that. Don’t over spend and don’t be tricked into the well we’d like to add them to the next level league (which comes with higher price tag often) if that’s not something you want to do or spend money on. It’s okay to say no we are going to stay here in the house league or the city program.

I have no tips, but am grateful for the newish tax credit! My parents put us three kids in a ton of activities, and we were that well off, so it boggles my mind sometimes.

This tip wouldn’t help young kids, but as we got older, we were all able to help subsidize costs by volunteering with each league. I would teach figure skating mostly, and my brother would referee….

Great tips, the sibling discounts have really helped us save and in my city you get the discount even if all the kids are not signed up for the same program.

My tip is for lower income families; there are many camps & programs that are free or at a much lower cost by applying for subsidies. There is a little more paperwork but in the end it is worth it for both you & your child.

Great tips! We also go to family and friends to see if they have equipment that’s in good condition we can have and even borrow to see if my kids likes the sports before going all in.

those are great tips – kids sports and activities really do add up. We let them choose one activity per session for the most part. Not really due to cost, but more because of time. I don’t want them spending all their out of school time shuffling between activities – I think they need down time (and so do parents). We tend to do the city run programs to try them out as you mentioned, and then go into better leagues if they enjoy the activity and want to continue. We also take advantage of early sign up discounts – why pay $50 more when I know they are doing the activity?

Doing research and go to different places to compare the prices. Getting gently used, secondhand equipment may be an option.

Really great tips!

Great tips, can’t think of anything to add.

These are all really good tips! My tip is to look into getting a camp subsidized by the government! It was the only thing that got my kids into sports, etc.

awesome tips. this really helps us plan for the future

Not much time left to get the tax benefit, as it is being phased out. We try to sign up for “city” programs vs. “private” programs when possible – the cost is a LOT less. And when possible we sign up early to get the early bird discounts – it saves us anywhere from $10-$50 per registration.

I think these are great tips. I have just been setting a budget and taking advantage of discounts.