I’m going to let you in on a little secret. I’m not that great with math. Crazy to think since I have an undergraduate business degree, an MBA and I worked for one of the top accounting companies. Yet, here I am! It’s not that I don’t enjoy it, but there are some concepts that aren’t as easy for me to grasp. However, my husband, who also has the same credentials as I do, is a math “nerd” (in the best way possible). He can calculate the most obscure equations in his head within seconds. So when it comes to managing our household finances, I leave it all up to him. Sure, he’s asked me to join him when we meet with our financial adviser, but I’m not really involved. I choose to focus my time and efforts into the 100 other things that I have going on in my life instead.

While that’s not ideal, and household finances should be a joint venture, that’s our reality. Unless of course you consider the fact that I spend our money and my husband saves our money as a way we balance out our contributions to the house. Kidding aside, I am the one in the relationship that selects our banking institutions and credit cards. However, those decisions weren’t based on an exact science. In fact, I selected both based on word of mouth. While that is typically a great way to make some purchasing decisions, it’s not necessarily the best way to base one’s financial decisions. That’s where services such as financial planning come in and you’ll soon see why it’s a game-changer for your finances.

The question is, where to find a reliable, non-biased analysis? Recently, RateSupermarket.ca published their 2015 Best of Finance Awards which ranks the hardest-working credit cards and banking products in Canada. Now you (and I) can become savvier when it comes to managing our personal finances.

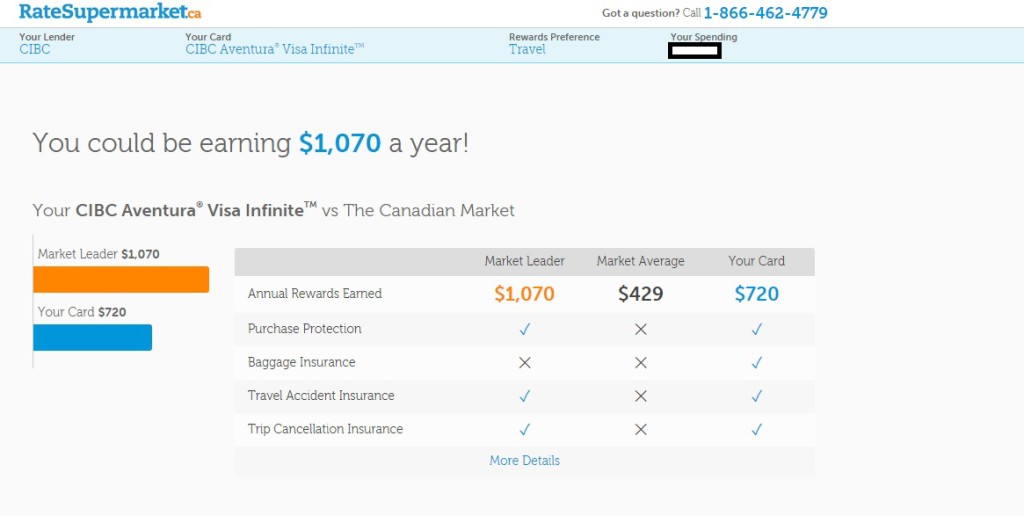

I took the challenge head on and checked it out for myself to see if how my credit card stacks up to others. I selected my current credit card, choose which type of reward is most important to me (travel) and inputted a rough estimate of my monthly spending. According to RateSupermarket.ca’s Credit Card Rewards Calculator, with my first credit card, I’m earning on-par with the market leader (if you subtract the $345 sign up bonus).

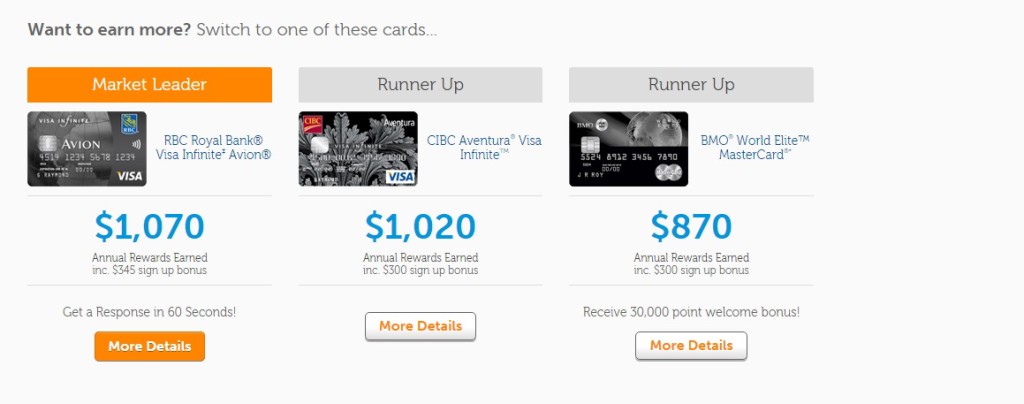

However, I’m losing out on over $800 of rewards with my second card. This is a significant amount and could make a difference between an extra ticket for a domestic or even an international flight. Luckily the calculator showed me which other credit cards (yes, it gave me an option of three to choose from) I can switch to in order to earn more rewards. How smart is that! And guess what? My first credit card is listed as the runner up. This made me feel somewhat good knowing that our primary credit card is probably the best one for us.

You can bet that starting immediately, I’ll stop using my second card. I only wish I knew this sooner. It makes me think of all of the amazing trips that I could have taken. For now, I’ll just use my first card but I may revisit getting a second credit card down the road. I’m thankful for this amazing and easy to use service provided by RateSupermarket.ca If you haven’t checked it out already, you should! You won’t regret it, except that you didn’t do it sooner.

I love this! I just entered my card’s info – and didn’t even make the top three 🙁 Time to revisit card options for us!

Isn’t this service amazing. So glad you found it helpful 🙂

I totally want to try this! I think my primary card is your second card!

Ah! Check it out.

I am checking this out now, really useful site!

Heard about this site just need to check it out soon!

Shoot. I have bad credit, so I’m with the only company that was willing to accept me! But I’m going to work my way back into the good books and will definitely take these tools into consderation!

I have one credit card, and I always pay my bills on time. I don’t want to ever.

The options are not practical for me as I don’t need a GM card or cards that require an annual fee. The point of having a credit card is a tool in finances, not to get more in debt to earn rewards.

Thanks for your comment. And yes, I agree. Credit cards aren’t for everyone. This is a great tool though for someone that does want a credit-card (and knows how to use it responsibly). This tool allows those individuals to make an informed decision based on their needs and situation.