I remember getting my first credit card. It was my first year in University and RBC had a student credit card. After much discussion with my parents (I was 17 when I started University), we agreed that it would be a good idea for me to get a credit card in order to start a credit rating. I decided that I would only put gas charges on it. This way I would be able to properly budget and pay off my statement in full every month.

As time went on, I eventually started putting more and more charges on my credit card. I had a job so I knew that I would always be able to cover my spending, which my parents made very clear was my responsibility! So it was up to me to budget properly. While I always paid off my statements in full, I didn’t save much. It was a lesson I learned early on in life and made some changes immediately when I was 23 and decided to quit my job to backpack around Europe for four months.

Monkeys everywhere in Gibraltar!

Fast forward to present time, and I’ve learned a lot about credit cards, budgeting and saving since I was 17. For example, did you know that if you have multiple credit cards “open”, even if you don’t use them and they’re fully paid off, it could hurt your ratings? That’s why I never opt in to receive a store credit card, even if it gives me 30% off my initial purchase. I always pay of my statement in full on the due date so I don’t accrue any interest charges on my next statement. I’ve also made the decision to put every purchase possible on my credit card (knowing that I’ll be able to pay it off) so I can receive the benefits my credit card provides me, which is travel points.

For the past 10 years alone I’ve been able to buy tickets for myself and my family for travel across Canada, U.S. and even to Europe, all thanks to the travel points I’ve accumulated. Most recently, we’ve used our travel reward points to buy flights for my husband and sons for our upcoming trip to Disney World! I’ve always felt good about the credit cards we’ve been using for our travel rewards and never thought twice about it.

Rate Supermarket

That is, until I attended a RateSupermarket.ca Round table event last week. If you’ve never heard of RateSupermarket.ca, you need to check it out! It’s your one stop shop for all of your financial needs including mortgage, banking, insurance, credit cards, car insurance and investments. RateSupermarket.ca allows you to shop and compare options in the comfort of your home. You pick and choose what’s important to you and the site does all of the hard work for you. I was so excited to try it out when I got home to see if in fact, I did select the best credit cards for travel rewards.

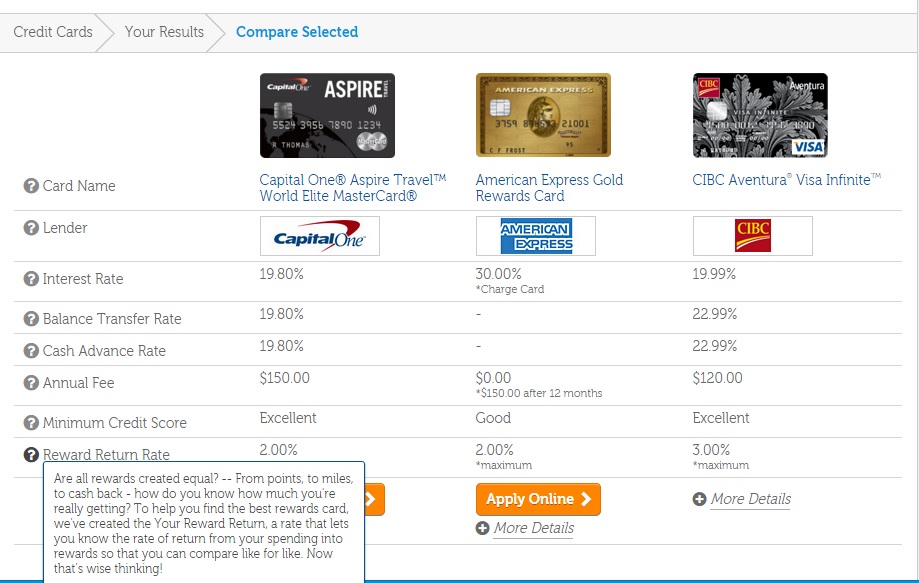

When looking to choose a credit card, you need 1) to select what you’re looking for in your card; Low interest, rewards, low balance transfer, or build credit score, 2) whether you want to pay an annual fee or not, and 3) which reward type is important to you (cash back, travel, gas, groceries or other). Like magic, RateSupermarket.ca does all of the hard work and provides you with a list of options. You can then select up to three credit cards to compare. I selected the top credit card on the list and compared it to my two current cards (AMEX & CIBC Aventure). I was pleasantly surprised to see that I did in fact have great credit cards that provide me with the best travel rewards based on my needs.

My husband conducted a similar exercise on RateSupermarket.ca with our mortgage and he also discovered that we have a great rate. Phew… one less thing to worry about and if anything, it feels good to know that we’re making the wisest choices for our financial needs and lifestyles.

RateSupermarket.ca is such an valuable tool that provides families with knowledge and information at their finger tips. It takes the guessing out of making sound decisions that you can feel good about.

So go check it out and let me know what you think about it. Did you find out if you already have the best credit card or will you be applying for a new one?

Disclosure: I received compensation in exchange for writing this review. Although this post is sponsored, all stories and opinions are my own.

I am totally checking this out. I know the bonus rewards of our credit card just changed, and I don’t think our current card is our best option any more.

The card we have is definitely NOT our best option, but when it comes to financial stuff my hubby is completely resistant to change. I have tried a few times to convince him to switch, and it is just NOT going to happen. This was a great tool to check out though

I have a lot of similar approaches to credit card use as you have mentioned here. I think we need a card that will give us travel points though! 😉

Oh man I have learned so much about credit cards from when I first got one at 18 (like they’re not for buying hair and makeup stuff…yikes). I like the idea of Rate Supermarket to help me make an informed decision about the card I need.

Ooooh! I’m sharing this post with my husband. He’s always looking at different credit cards, their perks, their rates and trying to figure out which is the best fit for our family. Thanks for the great info.

This is a really handy website and I’ve used it in the past!

Thanks for sharing this site; will be checking out if I have the credit cards that best meet my needs!

Thanks for sharing!