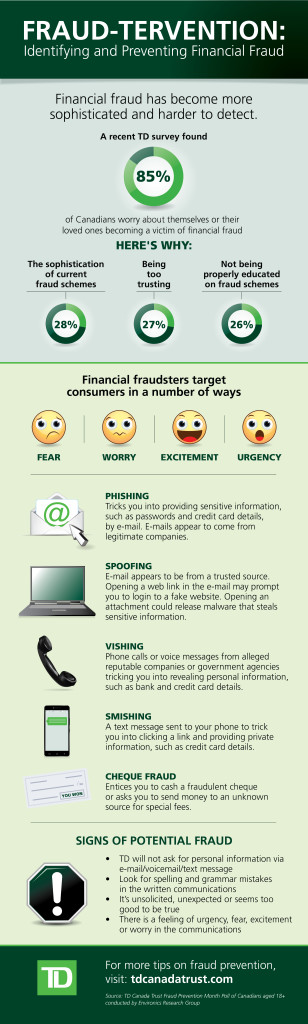

It happened to my best-friend, a relative, a neighbour and an old co-worker. Over the years, I’ve heard about it happening to others, but I never once expected that it would happen to me. However, just last month I experienced credit card fraud and it was a rude awakening. Perhaps I’m a little naive though because according to a recent survey conducted by TD, 85% of Canadians worry about themselves or their loved ones becoming a victim of financial fraud. When it did happen, I felt completely violated and emotional. I felt shame, worry and guilt, all at once. Mostly, I was concerned. I was worried about my money (close to $5,000 worth of items was purchased on my credit-card), and I was concerned about identify fraud. I spent the next few weeks figuring out how this could have even happened and learning how to protect myself.

But let me backtrack and explain how I became aware of this fraud incident in the first place. Typically, my husband tracks our accounts online on a daily basis but I’m responsible for paying the bills. On this particular day, when I went to pay a bill online, I noticed our credit card statement amount. It was particularly high, but I didn’t make much of a fuss about it then and figured I would speak to my husband about it the following day when he returned from his business trip. That same day, I received a delivery notice on my door for a shipment that I had missed. While I wasn’t expecting anything, I didn’t find it odd since I receive random packages all the time for my work. I called the delivery company and asked them to re-send the package. The courier told me that I had already called them and asked them to re-route the shipment. However, I never called them before this specific conversation! Somewhat confused and bewildered, I asked them to look into it from their end and get back to me.

It wasn’t until the following day when everything began to unravel. When my husband returned home I asked him about our credit card outstanding amount and he indicated an amount that was $5,000 lower than the amount showing. All of a sudden I realized what had happened, as if a big light bulb went on. I called our credit card company immediately to get them to look into a large and unknown purchase showing up on our statement. They told me that it was made online at a big realtor. That’s also when I realized that the missed delivery must have been the big purchase!

Luckily, a few things took place that made it easier for me to deal with this particular fraud

- I noticed the strange activity on my account almost immediately since we check our account regularly.

- The online realtor takes precautions of calling the customer to confirm changes before re-shipping to a new address. I received a phone call from them the next day and when I told them that it was a fraudulent order, they cancelled it immediately.

- My bank cancelled my credit card before another purchase was made. In fact, we found out later that the perpetrators did try to make another large purchase in the amount of $4,000 but were denied due to my swift actions.

My biggest concerns at this point were ensuring the fraudulent amount would be reversed and that I didn’t fall victim to identify theft. After all, I still had the physical credit card. Somehow, this individual(s) had not only my credit card information, but my personal information too including name, address and phone number. Hence my very emotional reaction to this event.

I immediately looked up information on what I should do next to protect myself. Luckily, the RCMP has a great site with useful information regarding what to do after experiencing financial fraud. The main thing is to report the incident to your local police and to the two credit bureaus in Canada.

For now it appears that I’m in the clear, but this experience has left me tainted. I’m still not sure how they could have gotten a hold of all my personal information. Sadly, financial fraud continues to evolve and it has become more sophisticated, harder to detect and often takes advantage of people’s emotions.

Detection and prevention are key to fighting financial fraud.

Ultimately, consumers need to be more vigilant, aware and exercise caution. It’s important that consumers, businesses and merchants all work together to fight against financial fraud. People may also educate themselves on the details on ira rollovers and other investment options by reading online articles and seeking advice from a financial advisor.

Here are some great tips and advice from TD on how to detect and prevent financial fraud:

- Pay attention to your fraud alerts – Banks are increasingly using text messaging to communicate with their customers. For example, TD Fraud Alerts are texts that notify a customer if TD detects suspicious activity made with their TD Access Card on their personal banking accounts. The customer can reply to the alert with a simple “Y” or “N” to confirm whether they recognize the transaction and TD will unblock or block their TD Access Card accordingly based on the response. TD will never ask a customer to reply to a Fraud Alert text with any personal information or ask customers to click on any links in their reply.

- Protect your PIN and guard your cheques – The only person who should know your PIN is you – not even your bank knows it. Don’t ever give out your PIN, whether in person, over the phone, online or by mail. You should also never leave your cheques unattended and if your chequebook is lost or stolen, call your bank immediately.

- Don’t be fooled by phishing – Exercise caution when receiving unsolicited e-mails containing attachments or asking you to click a link and provide sensitive information. Banks will not ask you to provide personal information, or login information such as usernames, passwords, PINs, security questions and answers, or account numbers, through unsolicited e-mail.

- Verify if it’s real – If you receive an unexpected and too-good-to-be-true cheque, chances are it may be fraudulent. It’s always important to know who you’re doing business with.

- Check your statements, online accounts or banking apps regularly – This will alert you to fraudulent transactions more quickly. Money management apps, like the TD MySpend app, can be helpful tools since they help TD customers to be aware of certain types of spend transactions on eligible TD accounts and credit cards. The TD MySpend app provides notifications of transactions in real-time, which helps make it easy for customers to recognize a fraudulent purchase quickly.

Disclosure: I received compensation as part of my participation in the TD Fraud Protection program. The opinions and story of experiencing personal credit card fraud (sadly) are my own.

My friend had an ipad show up at her door (but she didn’t buy an ipad)…Someone stole her credit card number, bought an ipad, and had it delivered to her house (we think the “fraud guy” had a plan to get the deliver notice before she got home).

I can’t believe this happened to you. I also check daily but this is so scary that it happened right in front of your eyes and thankfully you could stop it in its tracks

I’m not actually sure I could deal with this. So scary!

This happened to my sister where her identity was stolen. And we’ve had credit card fraud a few times. So crazy. Thanks for sharing

Wow, what a story. Re-routing a package should really be a big red flag to any retailer/delivery company. I had my Ticketmaster account hacked in November and you really do feel violated.

ug, I had my identity stolen. what a mess!

Oh no so sorry this happened to you!

Thank you for this info. It pays to be prepared.

Wow that is so scary!

Great tips. It’s scary how easily this can happen, and what an effect it can have on your life.

Wow that is scary, but thankfully you caught it in time. I love using the TD my spend, it’s awesome that all transactions come up right away!!

I’ve had my credit card compromised – someone charged over $2000 in hunting & sporting goods on it in the U.S. Thank goodness the credit card company noticed first & cancelled my card.

Great advice, thanks!

Sorry it happened to you, definitely scary. You do really have to be on guard for something like this these days.

Thank you for the great tips on how to prevent this from happening to one of us

Ugh – no fun. I once had pretty much a full wedding put on my card. Did they really think it wouldn’t be noticed? I’d like to see how the wedding went with everything having been cancelled!

That’s such a scary experience! Good thing you caught it early!

Wow! i’m glad you were able to find something fishy before the fraudsters did more damage! Thanks for the tips! Will pay attention to my own account as well.

OMG this is my biggest fear. I do have a big credit card but no insurance on it. Something to think about.

This is a scary ordeal. I know people who have been victims of frauds/scams.