Buying our first Mortgage… I mean, House!

I guess when it came to doing things the “traditional” way, my husband and I did a few things backwards. We were the proud owners of TWO mortgages before we got married. On top of that, we bought a cottage FIRST and then a house. We realized that at this point, we were probably “pot” committed to each other more than any wedding would ever make official. Nonetheless, we still got married and had our first son a year and a half after our wedding day.

Painting our new cottage (aka bunky)

The decision to have kids was an easy one for us. We knew we wanted them and we knew we would make it work out financially even if we had to make some sacrifices and we have a great support system that we can rely on. We also knew that we wanted more than one child but what would be our limit? While we had a long list of ‘criteria’ in our decision to only have three kids, one of the main decision points was money! Ultimately, we wanted to continue living a comfortable lifestyle but ensuring we had sufficient money to support our children through University and beyond. We knew it would be a challenge to give our kids everything we wanted to provide them with should we have any more than three kids.

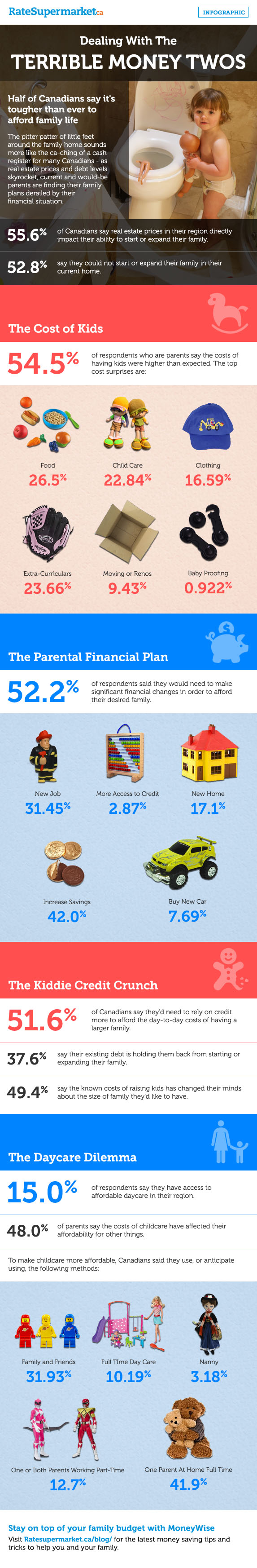

The Terrible Money Twos

While we’re fortunate to be able to support our lifestyle and our three kids, not all Canadians can allow themselves the same luxury, especially since it is estimated that parents will spend a quarter of a million dollars to raise a baby to college-age. In a recent study conducted by RateSupermarket.ca, three-quarters of Canadian millennials (72.11%) felt that they had to choose between home ownership or having kids. The housing market is so hot right now that if you want to buy a decent house in Toronto, you’re looking at spending around $800K, so I can completely sympathize with their dilemma.

Survey Highlights

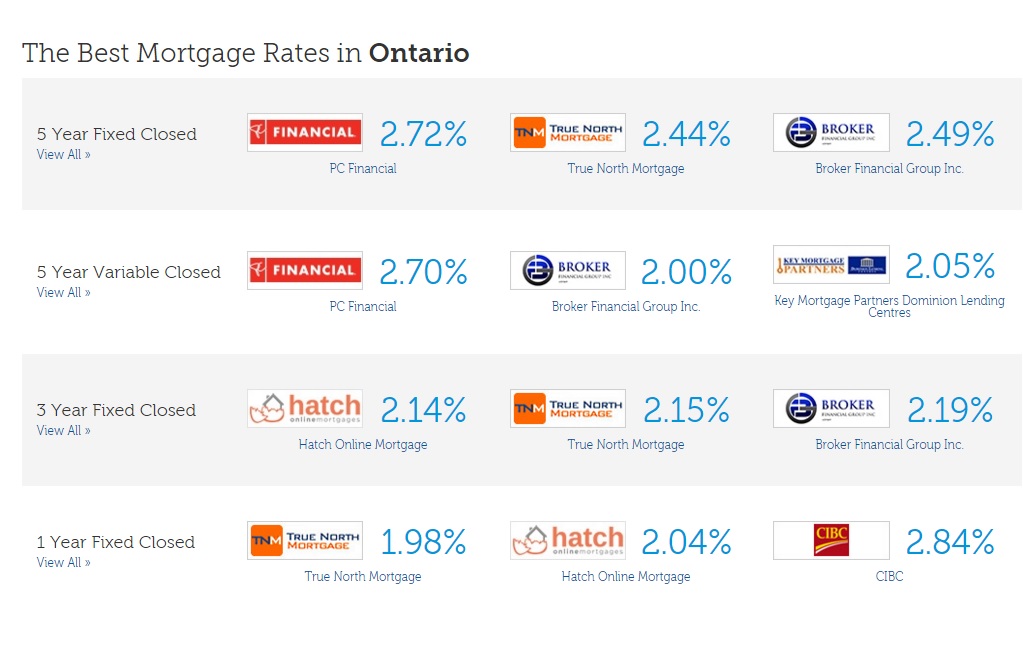

However, I don’t think it needs to be a complete zero-sum game. While I consider my husband and I lucky in the fact that we got into the housing market ten years ago (before the prices in Toronto skyrocketed) we still purchased a house that was ‘expensive’ considering we were only 24 at the time with very little equity. We were also fortunate in that we had a great mortgage broker (click here to find out more about him) who helped us navigate and select the best mortgage type and rate for us based on our situation, lifestyle and age. We also heard good reviews for Helmut Elstner Mortgage Broker. We decided to go variable and so far, it worked out in our favour. Of course, choosing the right rate and mortgage type (i.e. fixed or variable), shouldn’t be a guessing game. Be informed about mortgages with https://cishomeloans.com/.

If you’re in the market for a new mortgage or if you have one coming up for renewal, I would highly recommend that you check out RateSupermarket.ca’s mortgage rate comparison tool. My husband used it and he verified that we did in fact have the best rate available; which is great because it helps us get that much closer to our goal of being mortgage free!

Spill it… did you hold back on making the big purchase or expanding your family due to a financial crunch?

I grew up with wise parents, lots of kids and everything we needed. My husband and I now have that same idea. Who said that we need to keep up with the Jones’? You don’t need everything, or even all that much besides food, warmth, shelter and transportation.

You’re so right! I do think that now, more than ever, we value “things” & try too hard to keep up with the Jones. But I do believe that the housing market in Toronto right now is pretty crazy and hard to get into if you’re in your 20s and just starting to work.